RPA | Master Certification Use Case-2| Automation Anywhere- Part-51

A2019 Master Certification Use Case-2 - In this blog we will discuss regarding the master certification use case-2 wherein we will discuss first the problem statement, then will talk about the pre-requisites and finally we will discuss the steps to build the bot.

So first of all let us discuss the problem statement for the second use case in Master certification which are as follows:-

- Copy the file from one location to another location and rename it as per the given naming convention in the use case i.e. youremailaddress_Bot_2_Output.xlsx.

- Read the input file i.e. Acme_Weightbridge_SW_output.xlsx.

- open the renamed file that you copied into another location in point number 1.

- Then apply the formulas to calculate total charges before deduction and charges, green vehicle discount, hazardous wastes and total after deduction and charges.

Note : Do not use data table and database package while developing the bot.

Now we will discuss the steps that are required to develop the second bot use case for the master certification of A2019 Automation Anywhere also known as Automation 360. The steps are as given below:-

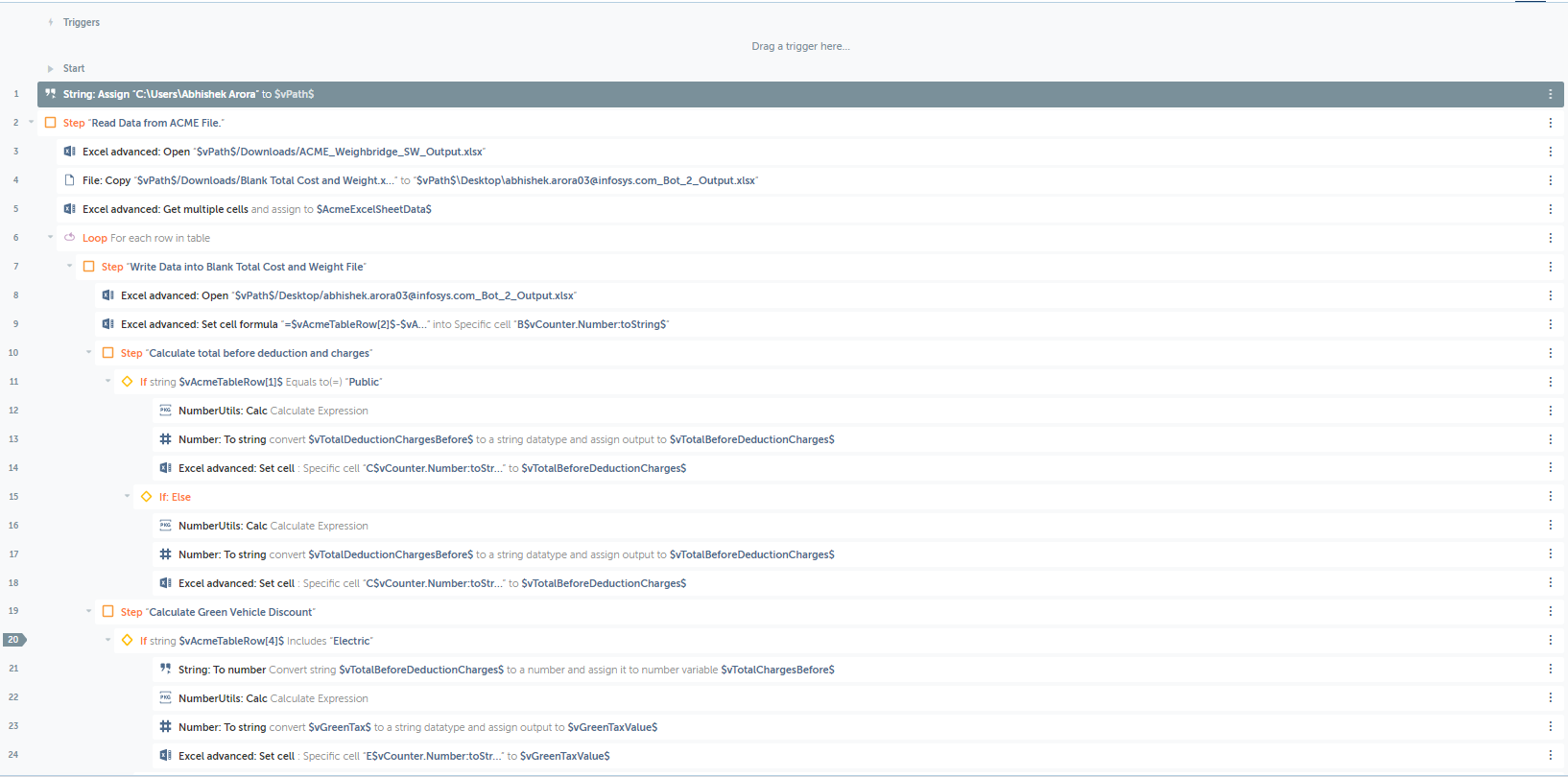

- Read the data from the input file. To read the data open the file from the desired folder location and use get multiple cells and in the properties section select all rows and assign the output to a table variable.

- For Total cost and weight subtract the third column value from the second column value and write this data into the output file i.e. Blank total cost and weight file. Place this command under the loop for each row in table command.

- To calculate total before deduction and charges subtract third column value from the second column value and divide it by 1000 and multiply it by 2 if sector column in the input file consists of public otherwise subtract third column value from the second column value and divide it by 1000 and multiply it by 20.

- For calculating green vehicle discount multiply total before deduction and charges by 0.03 if vehicle type is electric otherwise place 0 in the cell value.

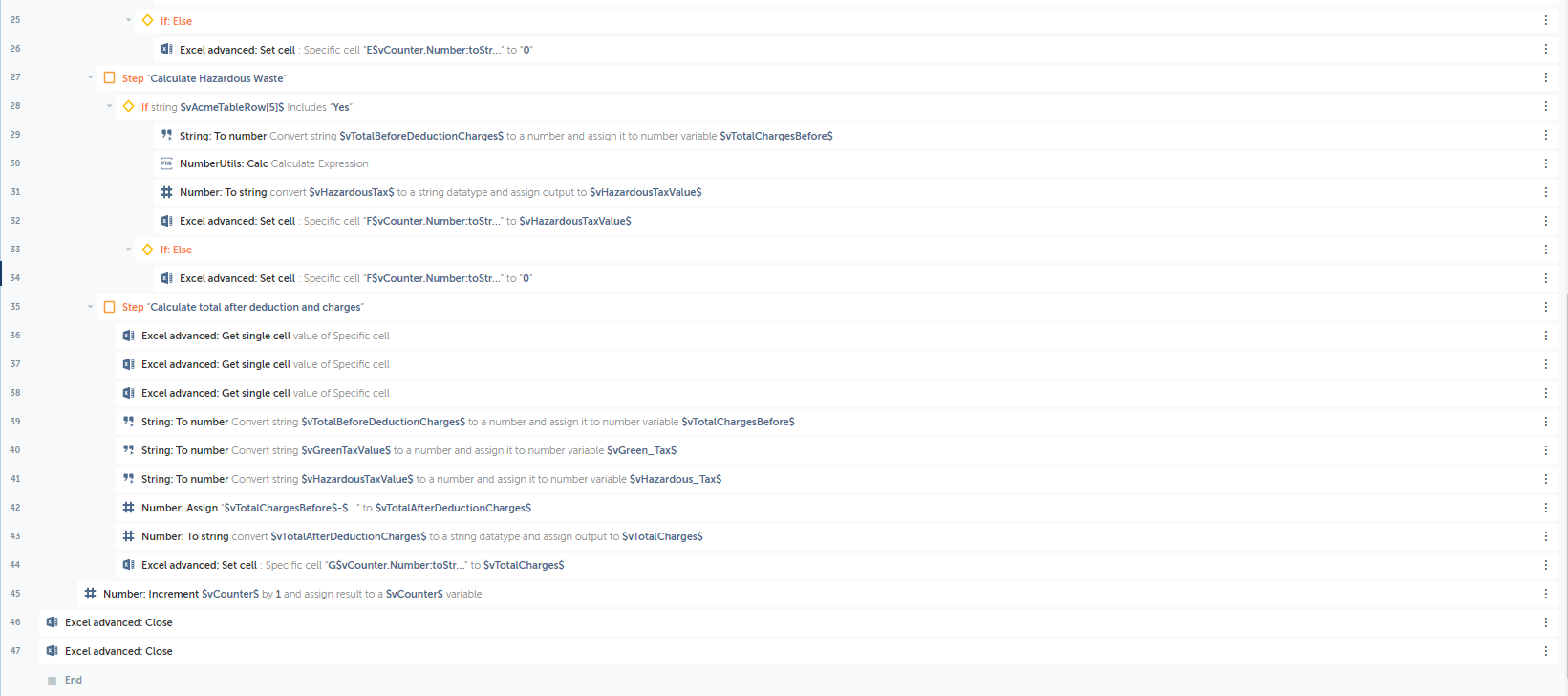

- For calculating the hazardous waste if hazardous column contain yes then multiply total before deduction and charges by 0.5 else place 0 in the cell value.

- Now to calculate total after deduction and charges subtract green tax from total before deduction and charges and add hazardous waste.

- Lastly close all the files that were opened during the development of the bot.

Here is the code snippet for the steps that we have discussed for the bot development.

With this we come to the end of our blog where we discussed in detail about the bot-2 use case for the master certification of A2019 Automation Anywhere.

If you have any queries regarding this blog then you can raise your queries in the comment section and I will be more than happy to answer all of your queries.

The video for the same will be uploaded soon on my YouTube channel.

Please provide your feedback on this blog once you go through this blog as the feedback that you provide really matters the most to me.

My bot is not able to perform the calculation on Step 12, vAcmeTableRow[2]-vAcmeTableRow[3]. It is fetching the right values, but its not calculating the proper value.

ReplyDelete